All in One Meeting Scheduler

Digitize Your Lending Journey from Application to Approval

Transform how you evaluate, process, and approve loans with MYTM’s powerful Loan Origination System — built to simplify lending and accelerate disbursement decisions.

Built with advanced technology and API integrations, MYTM LOS ensures every loan passes through a secure, transparent, and efficient digital pipeline resulting in faster approvals, lower costs, and higher customer satisfaction.

Streamline Digital Lending With

Our All in one Solution

STREAMLINE DIGITAL LENDING WITH

OUR ALL-IN-ONE SOLUTION

Application Processing (KYC/KYB)

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM's system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures, allowing you to validate applicant identities.

Document Management

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Credit Scoring

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Automated Underwriting

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Compliance Management

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Risk Assessment

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Communication & Notifications

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Integration with External Data Sources

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Workflow Automation

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

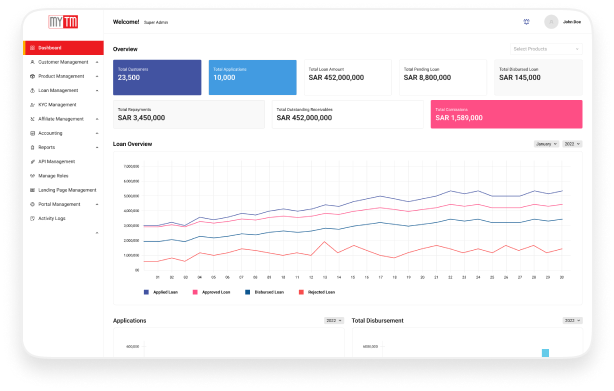

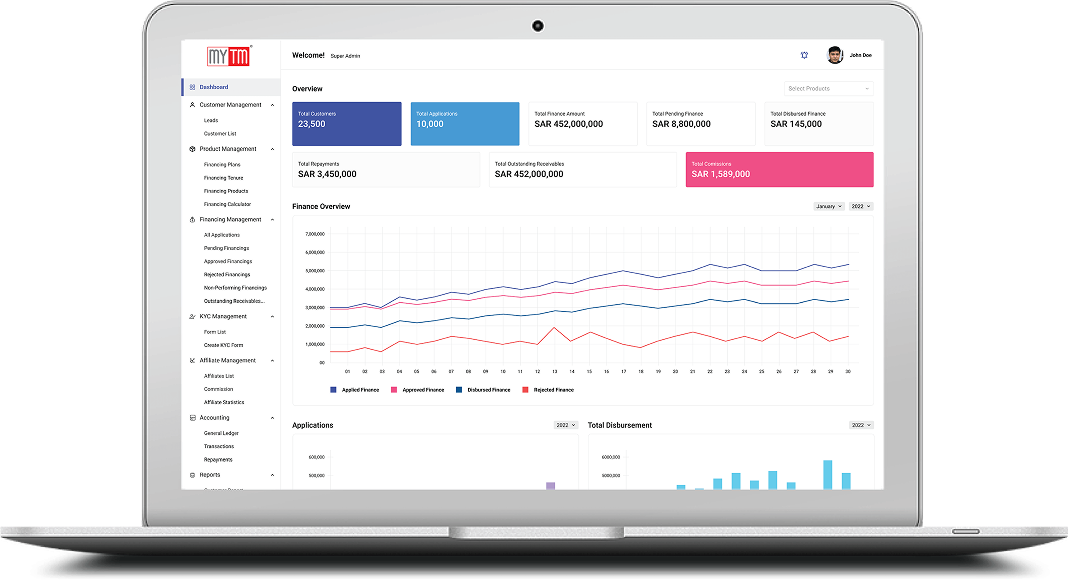

Reporting & Analytics

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Scalability

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

Mobile Accessibility

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM’s system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures.

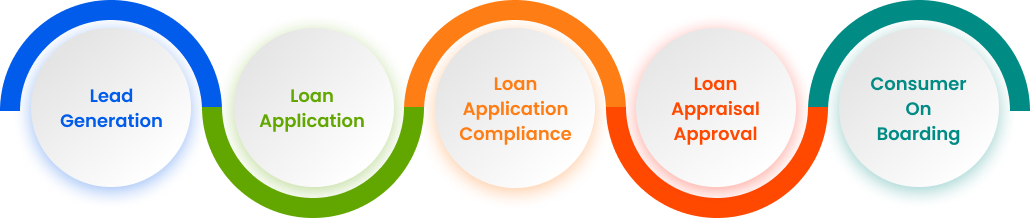

Process of Loan Origination Solution

MyTM’s Loan Origination System is a comprehensive suite of solutions that revolutionizes the lending landscape. From lead generation to customer onboarding, every facet is seamlessly integrated for maximum efficiency. The system stands out as the best loan origination software, offering tailored solutions for commercial loan origination.Here is the loan origination system workflow diagram:

Go Beyond Loan Origination Automation With These Solutions

News Media & Release

Top Features to Look for in an Appointment Management System

In Saudi Arabia's rapidly evolving financial landscape, driven by Vision 2030, fintech...

Top Benefits of PropTech in Real Estate Management

PropTech, or property technology, uses digital tools to transform how properties are ma...

Why Choose MYTM Core for Your Fintech Business

Saudi Arabia’s financial sector is evolving rapidly under Vision 2030. The govern...

The Role of Government Integration in Saudi Arabia’s Fintech Growth

Fintech in Saudi Arabia is not rising by chance. It grows because government integratio...

Why Card Management Systems Matter for Saudi Banks

Saudi Arabia’s banking sector is rapidly embracing digital transformation. Under...

Let’s get started!

Ready when you are just drop your email below

We’re excited to learn about your project and bring your vision to life.