Transfor Lending with MyTM's Loan Origination System

Are you in search of advanced and efficient loan origination software? Look no further! MyTM offers comprehensive loan origination system solutions that are designed to streamline your lending processes. From residential to commercial loans, our cutting-edge loan origination system software caters to diverse financial needs.

STREAMLINE DIGITAL LENDING WITH OUR ALL-IN-ONE SOLUTION

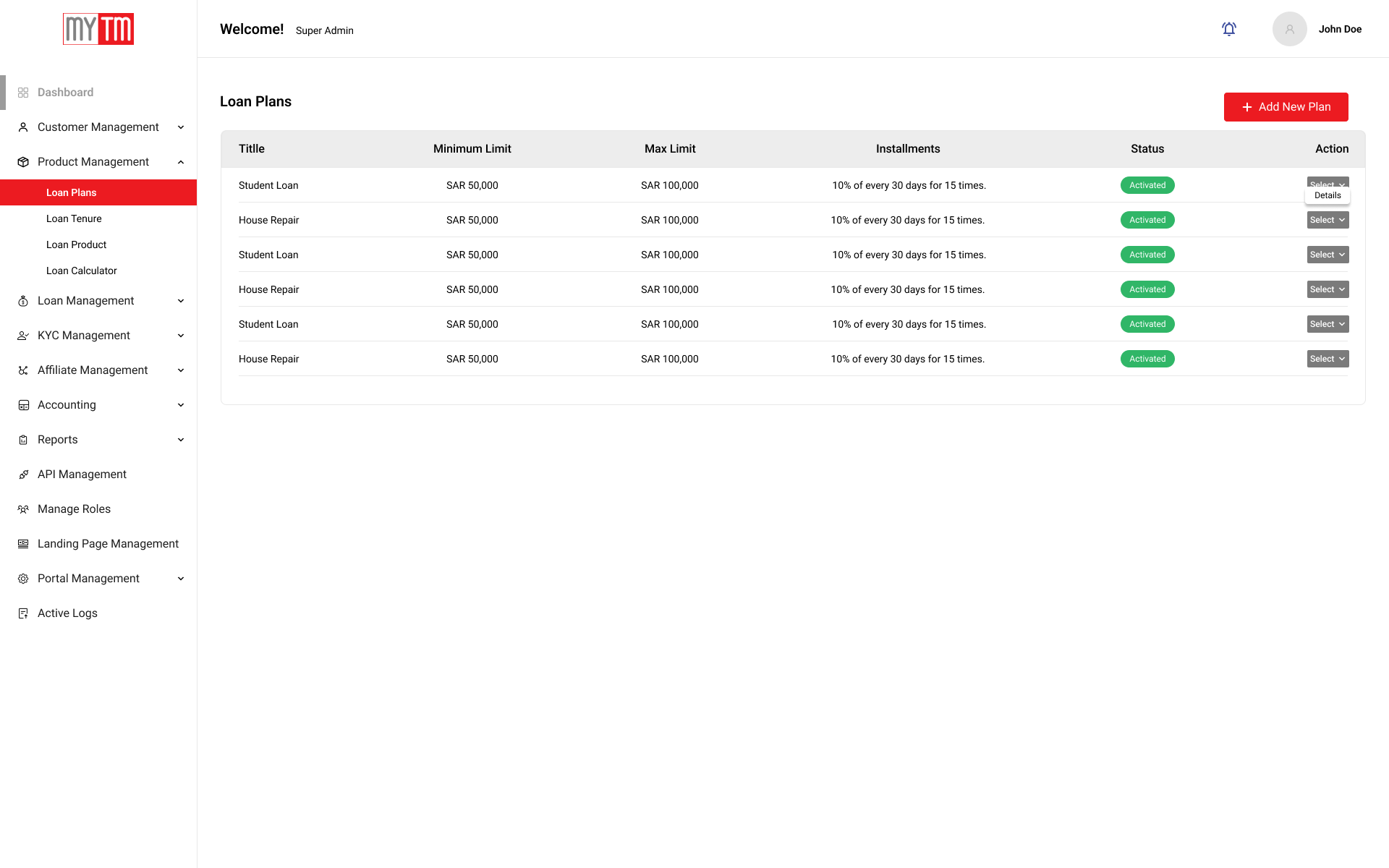

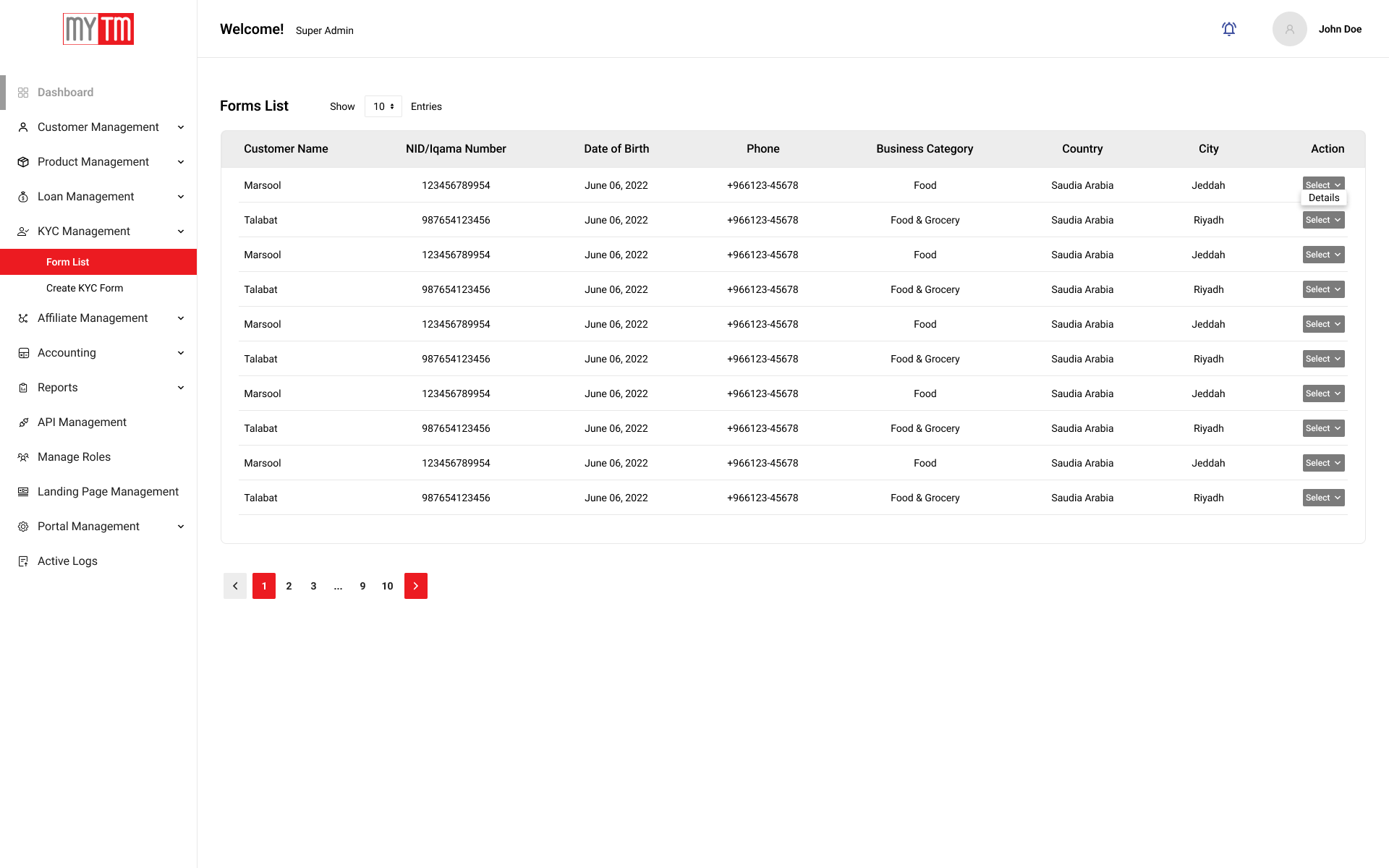

Application Processing (KYC/KYB)

Streamline At the heart of every successful loan origination is the accurate and efficient processing of applications. MyTM's system simplifies the Know Your Customer (KYC) and Know Your Business (KYB) procedures, allowing you to validate applicant identities and backgrounds swiftly and accurately.

Document Management

Streamline Efficient document management is crucial for a seamless lending experience. MyTM offers a robust document management solution, which streamlines the organization and retrieval of essential loan-related documents. Whether it's application forms, financial statements, or supporting documentation.

Credit Scoring

Streamline Responsible lending relies on precise credit scoring. MyTM's system incorporates advanced credit scoring functionality, allowing you to evaluate an applicant's creditworthiness effectively.

Automated Underwriting

Streamline Automation of the underwriting process is a key feature of MyTM's Loan Origination System. It significantly reduces the need for manual intervention, as predetermined criteria and decision rules are applied to evaluate applications.

Compliance Management

Streamline Staying compliant with constantly evolving industry regulations is vital in today's lending landscape. MyTM's system is equipped with compliance management tools that keep your institution updated with the latest regulatory changes.

Risk Assessment

Streamline Robust risk assessment is essential for responsible lending. MyTM's Loan Origination System provides a comprehensive framework for assessing potential risks associated with loans. This assessment equips you to make informed decisions.

Communication & Notifications

Streamline Effective communication and real-time notifications throughout the application process are central to creating a transparent and positive experience for applicants. MyTM's system ensures that applicants are kept informed about the status of their applications.

Integration with External Data Sources

Streamline Access to external data sources is critical for well-informed lending decisions. MyTM's Loan Origination System allows seamless integration with a wide range of external data providers, ensuring you have access to comprehensive data.

Workflow Automation

Streamline The system is designed to automate and streamline complex lending workflows, eliminating redundancies, reducing processing times, and enhancing the efficiency of your lending operations.

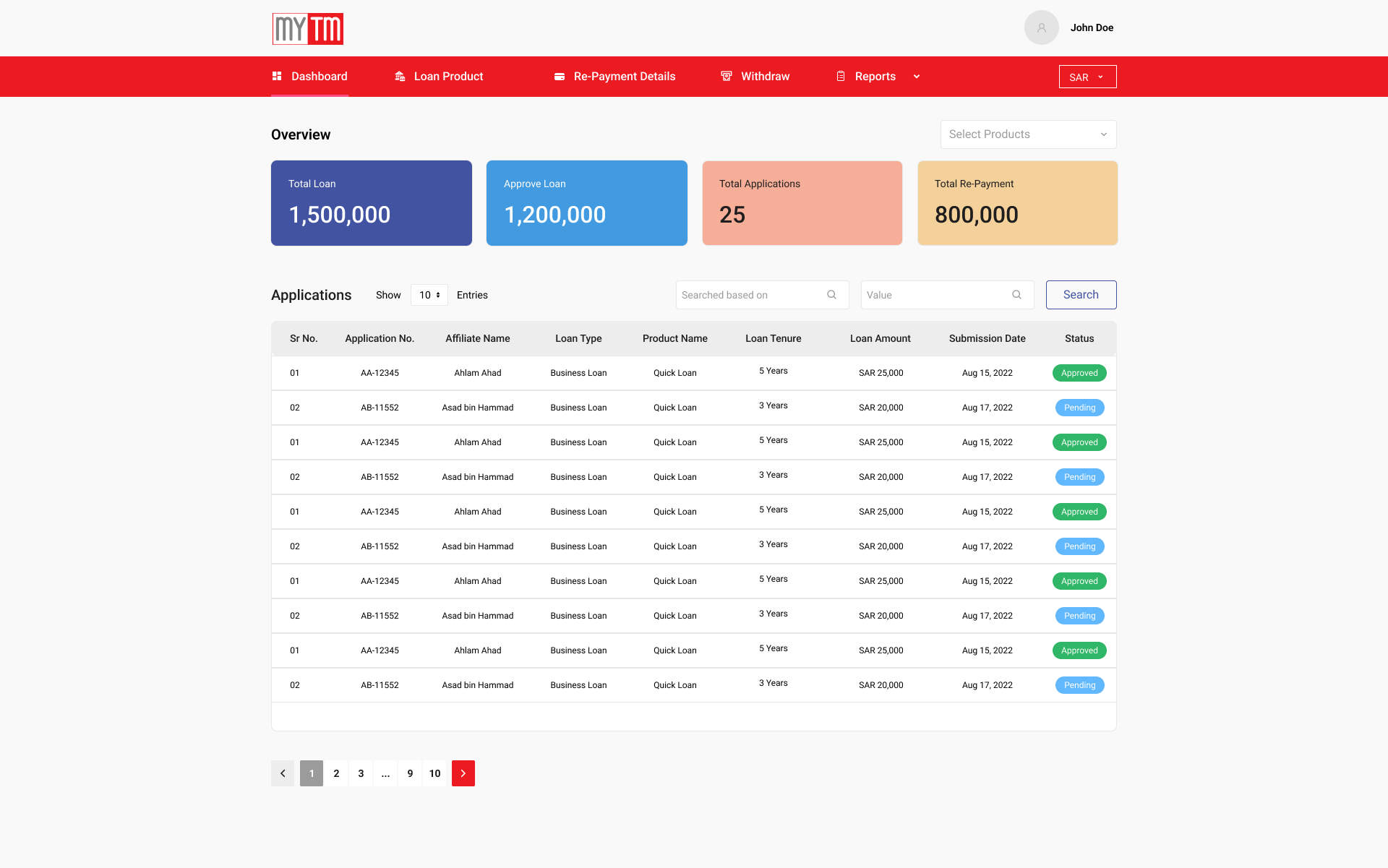

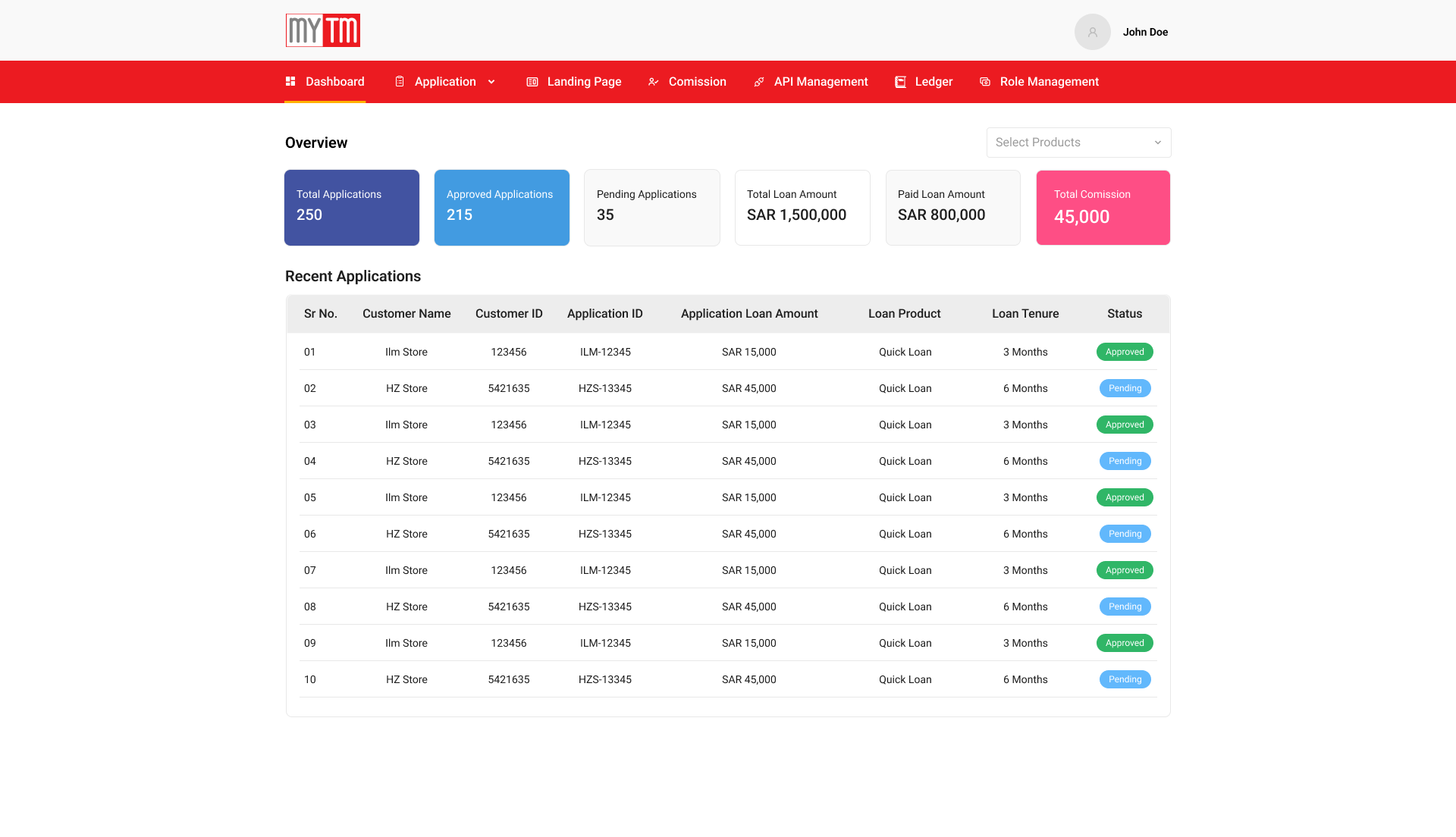

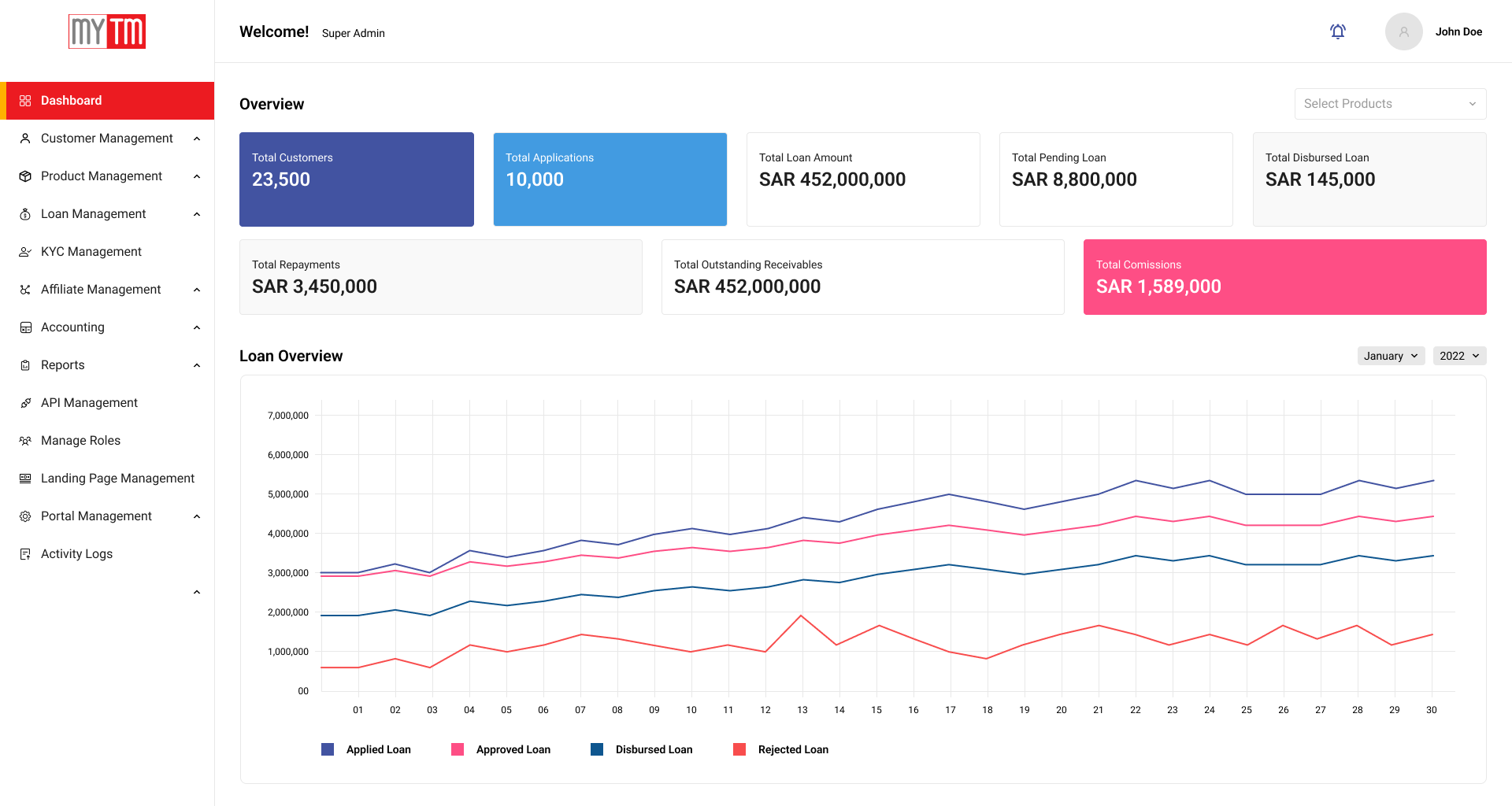

Reporting & Analytics

Streamline Data-driven insights are invaluable in the modern lending environment. MyTM's Loan Origination System offers robust reporting and analytics tools, providing deep insights into your lending operations, portfolio performance, and areas for improvement.

Scalability

MyTM's system is highly adaptable and scalable, catering to the unique needs of both small businesses and enterprises. Whether you're a startup or a well-established financial institution, our Loan Origination System can be tailored to your specific requirements, ensuring it grows with your business.

Mobile Accessibility

Recognizing the need for flexibility in modern business, our Loan Origination System is accessible on mobile devices. This mobile-friendly approach empowers your team to manage lending operations on the go.

Process of Loan Origination Solution

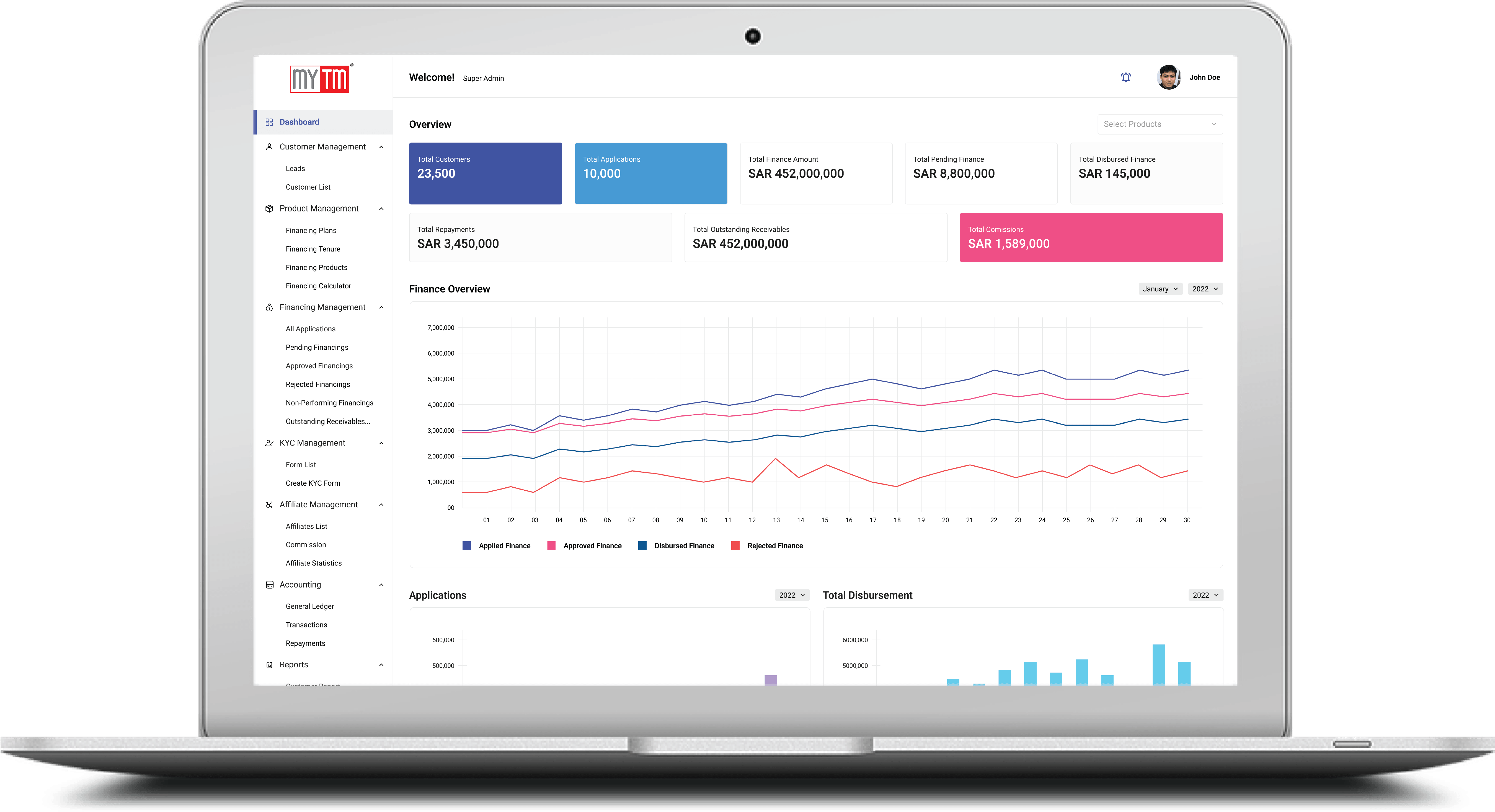

MyTM's Loan Origination System is a comprehensive suite of solutions that revolutionizes the lending landscape. From lead generation to customer onboarding, every facet is seamlessly integrated for maximum efficiency. The system stands out as the best loan origination software, offering tailored solutions for commercial loan origination. Here is the loan origination system workflow diagram.

Go Beyond Loan Origination Automation With These Solutions

Testimonials

"MyTM's Loan Origination System revolutionized our lending operations. The adaptability of

the system allowed us to seamlessly integrate it into our existing processes. From

compliance management to the intuitive B2C interface, it's an all-encompassing solution that

has significantly enhanced our efficiency."

- John Doe

"As a small business owner, finding the right loan origination software was crucial. MyTM's

system not only met our budget constraints but exceeded our expectations. The scalability

and user-friendly features have made loan management a breeze. It's the best investment we

made for our lending operations."

- Sarah Johnson

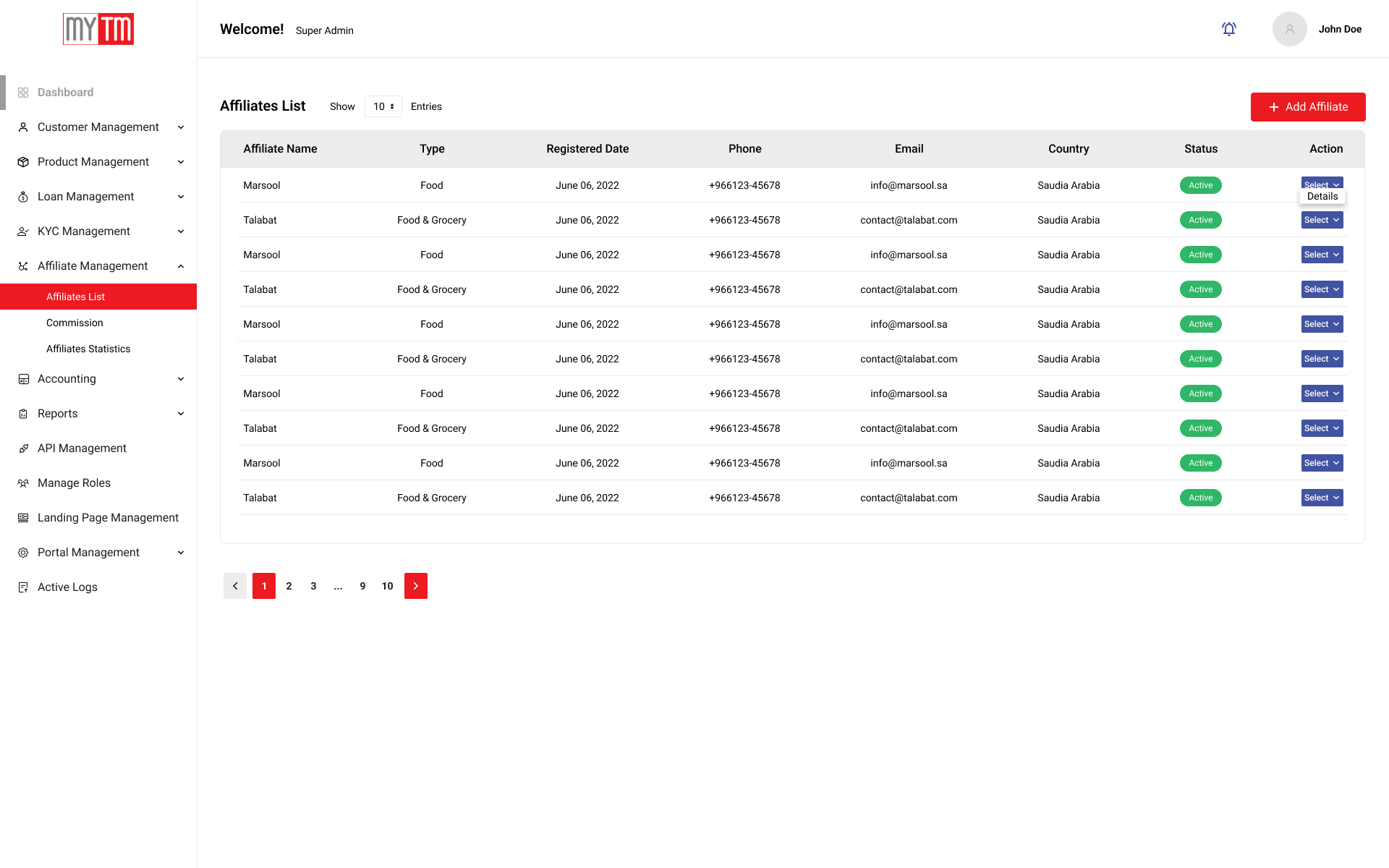

"The Loan Management Dashboard provided by MyTM's system is a game-changer. It consolidates

critical metrics in real-time, empowering our decision-makers. The system's ability to

handle diverse loan types, coupled with robust compliance tools, has elevated our lending

strategy to new heights."

- Amin Naseer

"We were impressed with the seamless integration of MyTM's Loan Origination System with

external data sources. This feature has streamlined our credit assessment process, providing

us with comprehensive information for informed decision-making. The system's security

measures also assure us that borrower data is in safe hands."

- Muhmmad Sohail

Frequently Asked Questions (FAQ)

Welcome to the FAQs section for MyTM's Loan Origination System. Here, we address some common queries about our comprehensive solution for managing lending processes efficiently and effectively.

At MyTM, our Loan Origination System is designed to meet your specific lending needs while ensuring efficiency, transparency, and compliance. If you have more questions or require further information, don't hesitate to reach out to our team. We're here to help you transform your lending operations with innovative technology.